Financial Statement |

|

Get the App |

|

The Financial Statement App contains Cash Flow and Net Worth (AKA Balance Sheet or Owners Equity) Modules, and is available for Android and Apple iPhone, and, a Web App.

There may be no more important thing that you do than completing a Financial Statement yearly. How do you know if your financial situation is improving without one? Compare previous years Cash Flow or Net Worth to this years. Will you be able to retire when you want to with financial security? If you don’t know where you are, and where you are going, you won’t.

![]() A link to a Video explaining the app.

A link to a Video explaining the app.

Once you have created a Financial Statement for the current year, create a best guess Financial Statement for the year you intend to retire. Your Income will be different and your expenses will likely be similar to what they are today. Compare them. How will you make up for the lost Income? How much Income will you have to make up to meet your Retirement Expenses? When will you start? How much time do you have left to fix it?

The Financial Statement App makes this easy and possible. Just follow the prompts and input the data, save a PDF and Print a copy for you or your lender.

Everyone needs to complete a Financial Statement. If you do not know if your Cash Flow is positive or negative, or whether your Net Worth is positive or negative, how will you know if, over time, it is getting better or worse? How can you plan for Retirement? This is the most important step you can take to prepare for Retirement. And, the earlier you start preparing your Financial Statement, the earlier you can start making improvements to your retirement position. This app will allow you to prepare a Financial Statement as often as you like. The best time to do one is as of the first of the year. Do it while you are preparing your taxes. Do it every year, and compare prior year to the current year to see if your Cash Flow is getting more positive and if your Net Worth is becoming more positive. If not, you need to make changes to your spending and investing habits to improve your position.

How many years do you have left to prepare for a secure retirement? Shouldn’t you start today?

These Apps cannot be purchased from the Website. You can click on the icons in the side bar to get to the proper store. They are to be purchased on your Apple or Android Smart Phone. Once you have registered and have your username and password you can access the Web App through the Icon on this page. The Web Apps are there to allow you to access the App on a larger screen where you may prefer to work. You may still work from your Smart Phone also.

The Financial Statement App makes this easy and possible. Just follow the prompts and input the data, save a PDF and Print a copy for you or your lender. You have the choice, once you purchase the App from your Android or Apple Smart Phone, to use the App on your phone or our Web App. Your username and password will work for both.

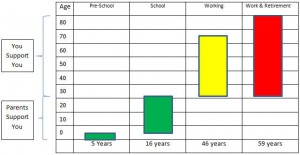

This graph tells two stories. One is that the 16 years you spend in school are about 21 percent of the time between the time you start school and you leave this world. Given that time is short compared to the rest of your life, you should put school first before friends and your cell phone.

The second story it tells is that you will generally work 46 years to save enough money to support you for 59 years, or 79% of the time. This means you need to save 28 percent of every dollar you make to support yourself in retirement. Consider investing in income producing products in order to supplement your income after retirement.

The Assumptions are that you start school at year 6, and graduate college at 21, and live to age 80. It also assumes you will not get any retirement of any kind, which is the trend for Social Security and for employment.

What happens if you run out of money during retirement or before? How do you avoid that? Create a Financial Statement. A Financial Statement consists of two parts, Cash Flow and Net Worth. Cash flow is equal to Income minus Expenses. Net Worth is equal to Assets minus Liabilities. You should do a Financial Statement annually, and graph your progress annually for both Cash Flow and Net Worth. You should also compare other Category totals also to give you insight as what you need to work on.

Once you complete the first Financial Statement, do another one that portrays what you believe the numbers would be when you retire. I think you will find that very few of your expenses decrease, but your income does decrease. If the After Retirement version Cash Flow is negative, you hopefully have time to consider how you are going to make your Cash Flow positive, before you reach retirement. There are many ways to do that, but without an idea what your goal needs to be, it is impossible to create a plan to make the Cash Flow positive after retirement.

There are a number of ways to create positive Cash Flow. If you have a positive Net Worth, you can convert some Assets to Income producing Assets. An example is buy Stocks that offer a Dividend. These dividends will be Income as they are paid by the Company represented by the Stock. Buy Rental Houses or Commercial Property, they will produce Income, and, the Asset should also rise in value. It is assumed that your Net Worth would not change by doing either of these. This means a house worth 100,000.00 shows up on your Net Worth as an asset worth 100,000.00 just as 100,000.00 of cash would. One could assume, over the long term, the Stock would not decrease in value either, meaning your Net Worth would not decrease. Cash is a liquid Asset, Stocks and Houses are a little less liquid, meaning it may take a little time to convert those into Cash.

The net Dividends and net Rental Income would contribute to Income for your Cash Flow. There are other ways you can look into, such as starting a business, that you can do to improve your Cash Flow picture after you retire. The key is to do the planning now. Understand what you need to do now. Then you can take time to figure out what would work best for you to reach your goals. If you do not know where you are, how can you know where you are going? Said another way, If you don’t know where you are, and you don’t know where you need to go, how would you ever expect to get there?

Posts will be moderated to prevent folks that do not read Help files from blowing off steam. Constructive criticism will be allowed and is appreciated.

Below are some screenshots from the App:

[table id=fs /]